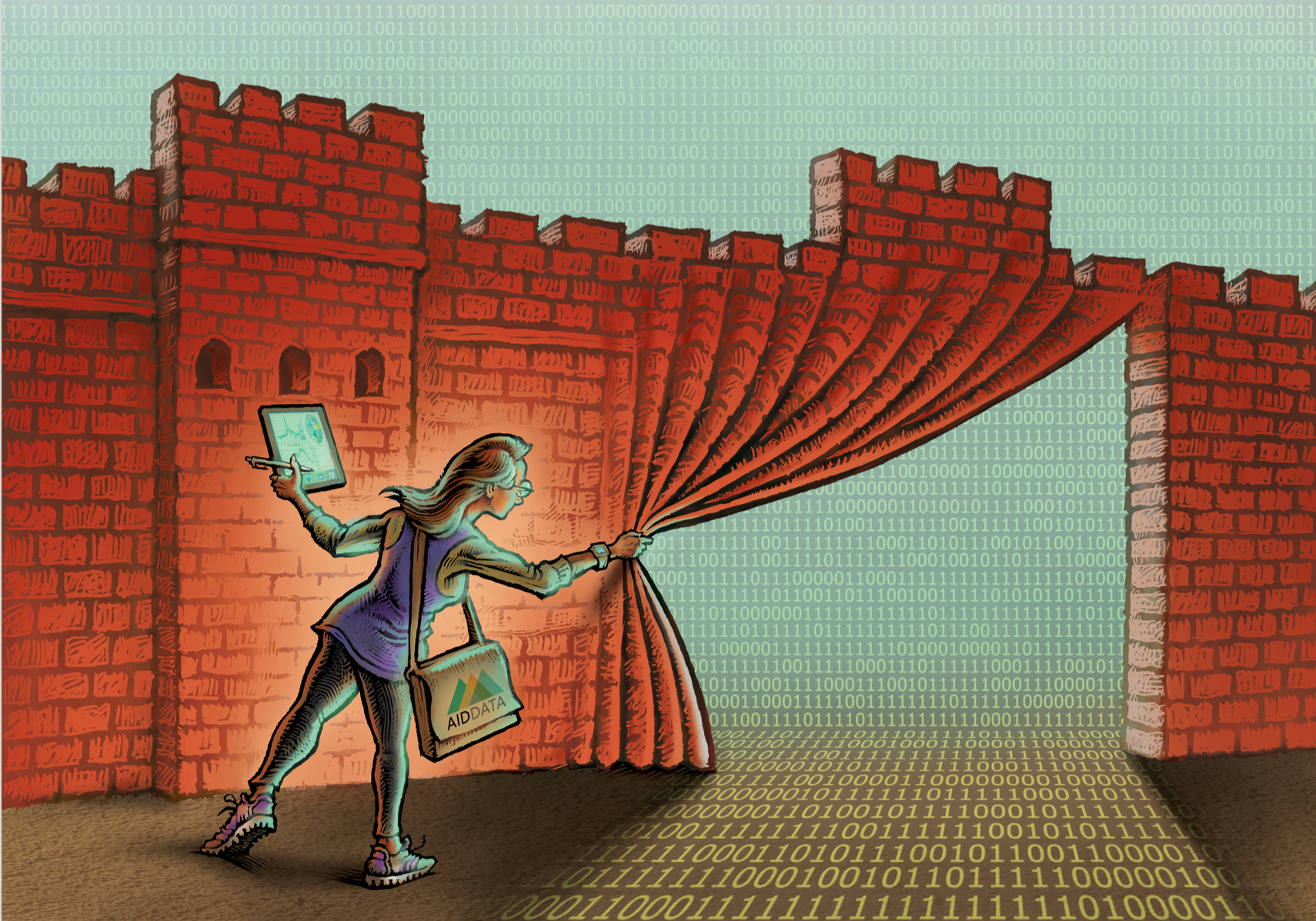

~ China has established itself as an economic and military superpower. However, with relatively few formal alliances, it faces some major hurdles to international influence — hurdles that it is now quietly working to overcome. • AidData, a research lab based at William & Mary’s Global Research Institute (GRI), will soon release a new dataset that sheds light on China’s vast portfolio of grant- and loan-financed projects around the globe. The numbers are staggering.

Tracking China

AidData sheds light on Chinese foreign aid

June 8, 2020

By

Leslie McCullough M.B.A. ’17

Illustrations By

Phil Foster

When Beijing first initiated its “going out” policy to promote Chinese investments abroad in 1999, it was primarily focused on encouraging Chinese enterprises to conduct business and make investments overseas.

However, President Xi Jinping has recently refocused this policy toward high-profile projects that might help China gain a reputational advantage visa-vis other great powers. Now, as the international community struggles to understand the true scale and scope of China’s checkbook diplomacy program, AidData is providing vital data and analysis.

In 2013, China launched the “Belt and Road Initiative” (BRI), which arguably represents the most ambitious foreign infrastructure investment program in modern history. Many of its overland routes parallel those of the ancient Silk Road trading routes to the Middle East and Europe. BRI also involves a far-reaching set of investments in deep-water ports along the perimeter of the Indian Ocean.

In order to fuel the initiative, Beijing has dramatically increased its overseas expenditure. This spending spree has not only created an opportunity to address unmet infrastructure needs in the developing world, but also to win the hearts and minds of citizens of foreign countries.

“Whether you like it or not, the era of great power competition is back. When the U.S. viewed itself as the only major superpower, it was less concerned about its ability to shape decisions in other countries,” says Samantha Custer, director of AidData’s Policy Analysis. “Now, China is jockeying for influence in many different theaters, and there is substantially greater interest in understanding what it is doing, where and why.”

China’s overseas spending now rivals that of the U.S., but very little was known about how and where this money was spent until AidData launched its research project eight years ago. Beijing considers the details of its overseas grant and loan program to be a state secret, which raises some critical questions: Is BRI a reputational asset or a liability? Does China’s spending make U.S. foreign policy more or less effective? What does China’s expanding financial footprint mean for the future balance of global power?

To address any of these issues, one first needs to be able to answer a more fundamental question: where and how is China spending its international development dollars?

Spending Shrouded in Secrecy

In 2011, when Austin Strange ’12 asked this same question, he had no idea the eventual impact it would have on the world. As an undergraduate studying economics and Chinese language at William & Mary, Strange worked as a research assistant at AidData. Since 2004, AidData has facilitated innovative research projects that bring students and faculty together to solve global problems using rigorous methods and cutting-edge tools.

AidData’s Executive Director Brad Parks ’03 and Co-Director of the Global Research Institute Michael Tierney ’87, M.A. ’88 were interested in the same question, and they proposed that Strange pursue an independent study project. The result was the development of an open-source methodology to track international spending by opaque donors and lenders. The Tracking Underreported Financial Flows (TUFF) methodology provides a systematic way of tracking aid and debt from emerging powers such as China.

“Our team combs through millions of records in nearly a dozen languages to identify and investigate overseas projects funded by government ministries, state-owned banks and enterprises and subnational localities in China,” says Parks. “Our goal is to triangulate information on each project that the Chinese government is bankrolling with as many reliable sources as possible. We track down the grant and loan agreements published in the official gazettes and legislative repositories. We scrape all of the project-specific information that is posted on Chinese embassy websites. We review aid and debt information management systems of finance and planning ministries in host countries. We correspond directly with government officials, investigative journalists and contractors on the ground with firsthand knowledge about these projects. Then, after standardizing and synthesizing all of this information we’re able to see the big picture — the known universe of Chinese government-financed projects.”

Beijing’s spending ranges from donations of trash cans and streetlights in Africa to billion-dollar loans to build power plants in Pakistan and Indonesia. All of this information is maintained in a centralized database that AidData manages and makes accessible to journalists, watchdog groups, government officials and anyone else who may want to use it. Initially funded through seed capital from William & Mary, this data collection and research program has attracted substantial funding from USAID, Humanity United, the MacArthur Foundation, Singapore’s Ministry of Education and others.

Since Austin completed his initial pilot project, AidData has built a team of more than 90 students, faculty and staff who use similar methods to study grants and loans from countries in the Persian Gulf, overseas investments by Russia and Beijing’s public diplomacy efforts around the globe.

While many countries report detailed information about overseas expenditures to the Organization for Economic Co-operation and Development’s (OECD) Development Assistance Committee (DAC) in Paris, others, like China and Russia, do not follow the international reporting standards established by DAC.

“This lack of transparency raises questions about how the money is actually spent,” says Parks. “William & Mary has become a go-to source of data and analysis about where these donors and lenders are channeling their resources and how the projects that they fund affect socioeconomic, environmental and governance outcomes.”

New Data, New Insights

AidData began its research program by documenting China’s financial footprint in Africa. Then, in 2017, it released an updated dataset, capturing more than $350 billion in grants and loans that supported approximately 4,300 projects across 138 countries and territories. Several years in the making, the dataset received global media coverage as the most comprehensive source of information on China’s global development footprint ever assembled.

“The benefit of AidData is that it fills the gap between what is announced, what is promised and what gets delivered. I think it is very well recognized by both researchers and practitioners as being a reliable source of information,” says former U.S. Secretary of Defense and W&M Chancellor Robert M. Gates ’65, L.H.D. ’98, who cites AidData’s research in his newest book, “Exercise of Power,” which will be released this June and identifies weaknesses in the way that the U.S. government uses non-military instruments of power. “Having a holistic approach to assistance, particularly when it comes to the Chinese, I think is really important.”

In spring 2021, AidData will release an updated global dataset that captures spending in 180-plus countries and territories through the end of 2018.

“Data collection is only part of the process. What we do with the data is far more important,” says Custer. “Much of the policy debate about China is guided by rhetoric and conjecture, not real numbers and facts.”

Custer believes that it’s not AidData’s role to provide opinions, but to provide data-driven analysis that allows others to make informed decisions.

“In the past, China’s lack of transparency has forced policymakers in other countries to make decisions based on assumptions and anecdotes. But AidData is now able to fact-check these assumptions against hard evidence,” says Custer. “The expertise of AidData faculty, staff and students at William & Mary has drawn high-level officials from governments and international organizations around the world to Williamsburg to learn more about the underlying motivations for and impacts of China’s global development spending spree.”

Revealing Information

More than 150 studies have now used data generated at William & Mary to evaluate the effects of Chinese development projects on literacy, infant mortality, economic growth and inequality, environmental degradation, corruption, debt sustainability and public opinion, among other things. Media organizations like The New York Times, NPR and The Economist regularly cite AidData’s work. AidData’s faculty and staff are frequently called upon to provide private briefings and expert analysis to decision-makers in Washington, D.C., London and Brussels.

But some of the other beneficiaries of AidData’s work may be surprising.

“You would think that if anyone knows what China is doing around the world, it would be the Chinese government itself, but Beijing is tight-fisted with information,” says Custer. “And we know that even government agencies, think tanks and university researchers inside China trust and use our data.”

With China shielding its project portfolio from public scrutiny, it can also be difficult for international aid agencies outside China to pinpoint areas of unmet need and avoid duplicating efforts. AidData seeks to bridge this informational gap and help governments and international organizations ensure that their resources are effectively and efficiently used.

“My view is that our own approach to developmental assistance needs to be dramatically revamped. But if we are going to do that, it needs to be based on real data in terms of what works, what doesn’t work, what amounts are out there — and what almost nobody does is connect what one or another group may be doing on the same problem in the same country,” says Gates.

Congressman Ander Crenshaw and Congressman Adam Smith, who previously served as the cochairs of the Congressional Caucus on Effective Foreign Assistance, have said that “AidData’s work to pinpoint the locations of aid projects, identify gaps in service delivery, and prevent duplication across donors is the type of foundational work that will make U.S. foreign assistance more efficient and effective in the long-term.”

Former U.S. Secretary of State Condoleezza Rice has echoed this point, noting that “when you look at AidData’s spatial maps, you can better tell where aid was needed and change your targeting strategy, instead of funding activities in the same parts of the country, time and time again. The data provides a valuable guide for decision-makers to see where all the work is concentrated so they know where they can have the most impact.”

AidData’s work also assists leaders in low-income and middle-income countries, such as Nepal and the Maldives. China’s assistance programs are often highly fragmented across multiple agencies and layers of the government. The data gives those receiving assistance from China more transparent information about the projects it funds.

“Chinese development finance is extremely complex to navigate. It involves many different projects with varying terms and conditions,” says Custer. “This complexity, combined with limited transparency, makes it difficult for countries borrowing from China to know exactly how much they owe and opens the door to potential corruption and abuse.”

In the midst of the global financial downturn stemming from COVID-19, countries may see their economies contract in ways that make servicing their debt burden to China unsustainable. Meanwhile, China’s own economic constraints from the crisis may make it less willing to negotiate new terms, which could further exacerbate a potential global depression.

Building Indebtedness

While many people assume that China’s foreign aid program is new, that is not the case. Dating back to the 1950s, China provided assistance via grants and lowor no-interest loans for smaller projects. But China’s overseas development program has now changed in two important ways. AidData has demonstrated that, over the last two decades, China has dramatically increased its spending on big-ticket physical infrastructure projects such as roads, railways, ports, power plants, electricity grids and telecommunication networks.

Since many Western aid agencies, like USAID, primarily focus on issues such as public health, democracy and human rights, developing countries increasingly look to China for help with their infrastructure needs. In fact, AidData has shown that nearly 90 percent of China’s overseas spending focuses on infrastructure.

With nearly 60 variables in its data set, AidData provides unique insight into the ways in which China designs and implements these overseas projects. In addition to information about the size, purpose, location and status of each Chinese project, AidData tracks contractual terms and conditions. For example, if a project is supported by a loan, what is the interest rate? How long does the borrower have to repay the loan? Did the lender agree to a grace period before repayment begins?

“What you can see in our data is that China has pivoted toward less concessional and more commercially oriented lending,” says Custer. “It used to mostly offer grants and interest-free loans. But now we are seeing more of an emphasis on lending at market or close-to-market rates.”

However, while working with China may cost more in financial terms, leaders in lowand middle-income countries still find Beijing to be an attractive partner in two respects. First, China does not demand involvement in the borrowing country’s government with regard to the economy, fighting corruption, increasing transparency or protecting human rights. Second, China is one of the few foreign powers that is willing to bankroll large-scale infrastructure projects, which many countries view as critical to spurring the growth of their economies.

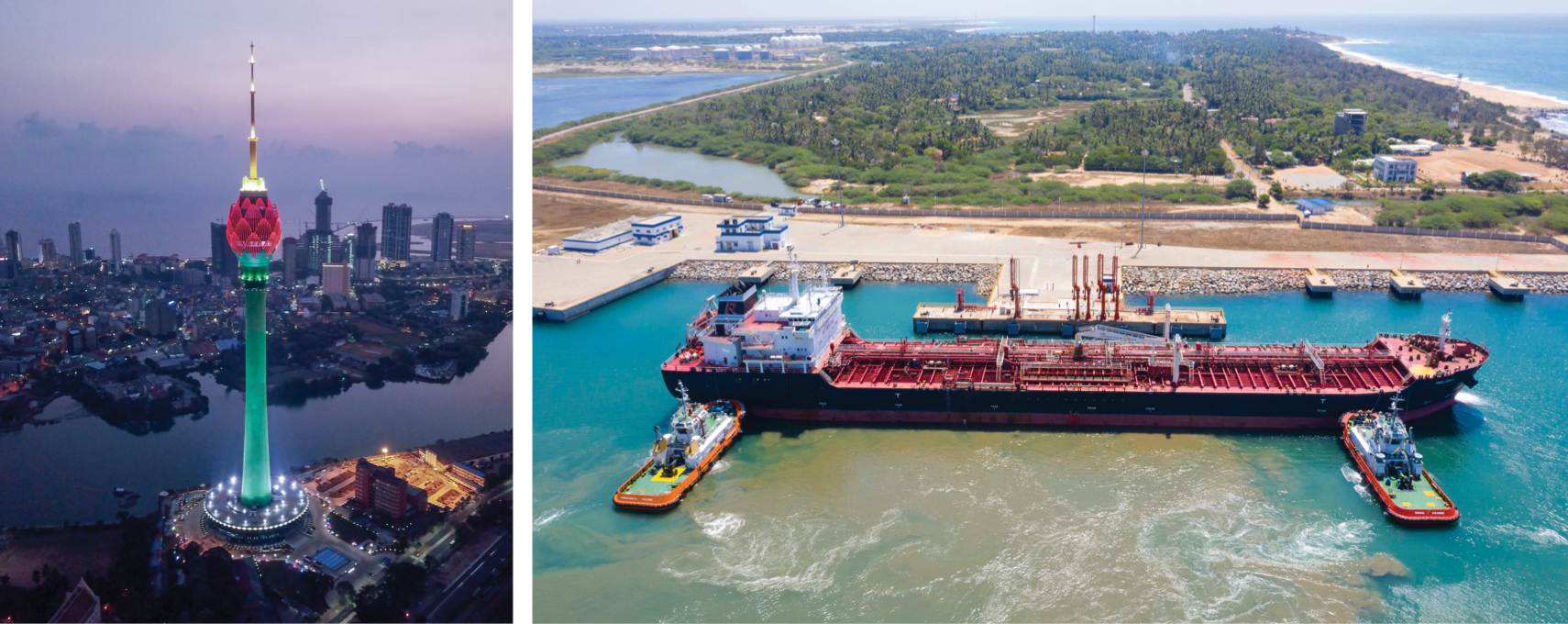

Yet this growing enthusiasm to borrow from China has also triggered intense debate about the potential downsides for recipient countries down the road. What happens if a country can’t repay a Chinese government-backed loan? Sri Lanka’s experience in 2017 serves as a cautionary tale. When Sri Lanka had difficulty servicing its debts for the Hambantota Port Development Project, China eventually took over the port and 15,000 acres around it, an arrangement that will be in place for 99 years.

“Sri Lanka’s inability to repay its debts was not solely because of China, but the Hambantota Port story underscores the importance of why leaders and citizens alike need more information about the terms of these deals,” says Custer. “How many of these loans are backed up by collateral, and if a borrowing country defaults, what happens next? Will China seize strategically important assets?”

The public backlash around the Hambantota port deal was also a powerful lesson for Chinese leaders that their high-profile infrastructure projects are a double-edged sword. On the one hand, says Custer, “these financing deals can give China implicit leverage with foreign leaders when it comes to an important vote in the United Nations or a trade agreement with preferential terms for Chinese companies.” On the other hand, local perceptions of China can change dramatically over time if the promised benefits from a project are not delivered or the costs begin to outweigh the benefits.

With the data that AidData produces, researchers are beginning to answer key questions.

A New Colonial Power?

What is motivating China’s growing presence in the development finance market, and what does it get out of it?

“Some politicians, journalists and scholars argue that China is a neo-colonial power using its economic clout to buy influence with other countries,” says Custer. “Regardless of whether you buy this argument, it does raise an important question about what China hopes to achieve by backing major development projects in other countries.”

Through AidData’s new dataset, researchers can answer this question by investigating the profiles of countries that seem to get more grants and loans from China.

“It is not necessarily the case that the poorest countries and subnational localities get the most financial support or the most favorable deals,” says Custer. AidData has shown that China finances an unusually high number of projects in the hometowns of presidents and prime ministers. It has also demonstrated that when countries vote with Beijing in the United Nations General Assembly, they get extra cash from China.

Beyond its pursuit of commercial advantages and foreign policy concessions, China is clearly interested in winning hearts and minds. It often bankrolls high-profile projects with substantial media fanfare inrecipient countries. These projects have garnered Beijing publicity and praise from citizens and leaders in lowand middle-income countries that view partnership with China as a gateway to economic development. At the same time, a growing number of media articles highlighting waste, fraud and abuse associated with Chinese-government backed development projects have put Beijing on the defense and forced it to justify how its investments benefit local communities.

U.S. Implications

China is now a major player in the international development finance market, but its profile is quite different from that of the United States. The U.S. primarily gives grants to tackle challenges related to public health, disaster response and democratic governance, while China mostly provides loans for big-ticket infrastructure projects.

According to Custer, “If you look at aid in the strict sense of the term, the U.S. gave four times as much as China to other countries between 2000 and 2014. But when you consider all types of government financing, China and the U.S. look like spending rivals.”

China provided $354 billion during this period, and the U.S. gave $370 billion.

“When we update our figures through 2018 at the end of this year, we may see that China is actually outspending the U.S.,” says Custer.

This new reality raises critical questions for U.S. leaders when they think about the future of development assistance as part of America’s broader foreign policy toolkit. Are there constructive ways in which the U.S. can engage with China to ensure that its lending maximizes the benefits and minimizes the risks to recipient countries? Or should the U.S. seek to counter or compete with China’s growing influence in lowand middle-income countries as a threat to American interests?

Regardless of the answer, China’s prominence as a player in the development finance market is not something that the U.S. can or should ignore. At a minimum, it needs to learn from what China is doing, but it may also need to rethink its existing strategies.

Comparative Advantage

“We are not in a unipolar world anymore,” says Custer. “China has clearly demonstrated that it has the means and motivation to deploy the power of its purse to advance its interests in ways that may or may not be aligned with the U.S. and its allies. In practice, this means that U.S. leaders will need to determine how best to engage with China as a financier of development in ways that safeguard U.S. interests and those of developing countries.”

One potential way forward is to explore avenues for closer cooperation with China, such as through co-financing of development projects in areas of common interest, as a way of nudging Beijing to play by established global standards, rules and accountability systems.

“If we don’t create space for an emerging China to be at the table as an equal player, then they will continue to work around prevailing international rules with limited transparency,” says Custer.

However, if the U.S. wants to preserve its own influence, it also needs to consider why countries are so keen to work with China. By undertaking surveys of decision-makers in more than 125 countries around the globe, AidData has uncovered evidence that aid donors are more influential when they align their assistance with the priorities of recipient countries. In this respect, the U.S. would do well to be more responsive to the interests of lowand middle-income countries in developing robust infrastructure.

At the same time, Custer acknowledges, “I don’t know that the U.S. is in a position to outcompete China in terms of infrastructure investment, but what it can do is make sure that recipient countries are not opening themselves up to undue influence as a result of runaway debt or projects that inadvertently worsen social and environmental standards. That’s not only bad for those countries, but also for U.S. interests.”

To that end, the U.S. could potentially play a constructive role in helping countries on the receiving end of China’s largesse to strengthen their accountability systems to more effectively manage public debt, negotiate deals with more favorable terms and conditions and ensure that infrastructure projects are implemented in careful and sustainable ways. The U.S. could also consider investing in things like a recipient country’s independent media that can engage in investigative journalism to open up space for debate and discussion about these agreements and projects.

Path Forward

Some U.S. politicians emphasize investments in defense at the expense of diplomacy and development, but others argue that this approach is wrongheaded because it will undermine U.S. leadership on the global stage.

“If we’re going to be successful in this long-term rivalry with China . . . we’re going to have to redevelop, and in new ways, reimagine these non-military instruments of power in order to compete with things like China’s ‘One Belt One Road’ plan,” says Gates. “I think that the biggest concern I have is that even though we now have a bipartisan understanding that China is a challenge for us, we have no strategy. Where do we want this relationship to be in five or 10 or 15 years and, more broadly, how do we counter the Chinese in all the different areas where competition is going to take place?”

“One thing is clear,” says Custer. “The size of China’s overseas development program can’t be ignored. If it continues to provide large-scale financing behind closed doors, there are real risks that the U.S. will get displaced and China will have undue influence. It is already beginning to happen and nobody’s watching.”

Until now. The upcoming release of AidData’s newest global dataset will shine a bright light on the true scale and scope China’s overseas spending and reinforce William & Mary’s position as a leader in global development research.

Stay up to date on AidData's research about China, along with other research topics, updates and events and subscribe to AidData’s newsletter.

Learn more about the Global Research Institute’s research, events, and opportunities and sign up for the GRI newsletter.